In Quickbooks, when a customer pays by credit card, you are able to write down the credit card fee to a credit card expense account directly in the payment screen. Dolibarr is a bit different, requiring an extra step. We will look at difference and show you how to split payments from credit card processors in Dolibarr, using Paypal as an example.

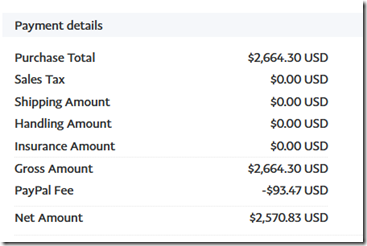

We are going to assume a customer has paid the amount of $ 2664.30 and the credit card processor (Paypal) has charged us a $93.47 processing fee, leaving us with $2570.83.

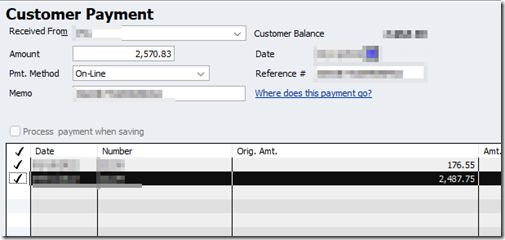

Receiving Payments and Expensing Credit Card Fees in Quickbooks

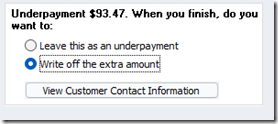

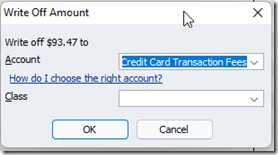

In Quickbooks, we would receive the net amount $2570.83 as the customer payment amount. We would register the difference as a write-off from the bottom-left hand sub-menu, then select a credit card expense account.

Basically, Quickbooks is taking the full amount and splitting it between the net and gross. It takes the net amount and credits the undeposited funds account and takes the fee amount and credits the credit card expense account. When we look at undeposited funds, we have the net amount that the credit card processor leaves us with, which is $2570.83. It’s double-entry accounting, only it’s shielding you from the inner-workings of how ledger entries work.

Receiving Payments and Expensing Credit Card Fees in Dolibarr

In Dolibarr, the underlying accounting is the same however the process is a bit different. In Dolibar, you have to understand how money is moved around in the ledger. It’s a true double-entry accounting system and it assumes you understand the underlying ledger entries that go into receiving money. Here’s the same transaction in Dolibarr.

Note that in software where you have more control, there is usually more than one way to accomplish a task. The method below is just the way I do it.

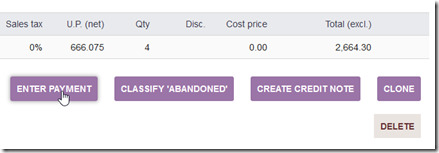

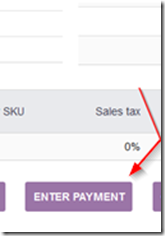

First, select the invoice and click on the enter payment button.

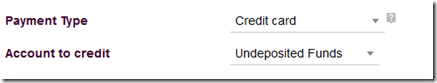

Select your undeposited funds asset account as the account to credit.

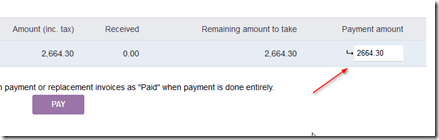

In the payment amount, enter the gross amount that the customer is paying.

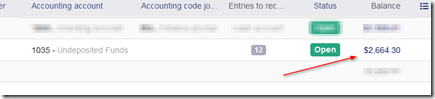

Click on the pay button to finish. The gross amount be credited to your undeposited funds account.

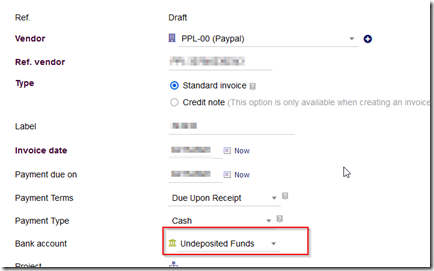

Now create a Vendor invoice for the credit card processor’s fee. As you can see we have a vendor named PPL Paypal. The bank account should be withdrawn from undeposited funds.

Creating chart of account items is beyond the scope of this tutorial but you need to have an expense account for credit card fees and a service item for credit card fees that credits an expense account

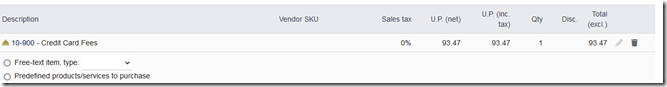

Select that item and enter the credit card processor’s fee amount.

Save the invoice then click on the select enter payment button to pay the vendor invoice amount.

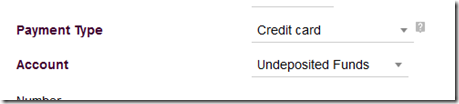

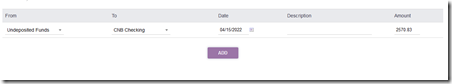

Select undeposited funds as the account to debit and pay the invoice.

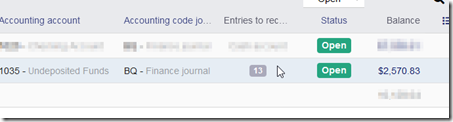

You will see that the credit card processor’s fee has been debited from the undeposited funds and credited to the credit card fee expense account.

When you are ready to transfer from undeposited funds to your bank account, the net amount will be the transfer amount, matching your credit card processors balance.

Obviously you don’t need to create a vendor invoice for each credit card transaction, only when you are going to deposit the credit card funds into your bank. You just create a single vendor invoice for the total amount that your credit card processor is charging you for all the credit card transactions.